In general, though, customers are satisfied with Wave’s products and customer support. Run payroll in 100+ countries and 200+ currencies from a single place. Deel’s comprehensive global platform eliminates the ongoing admin of local compliance, taxes, and benefits. With in-house experts across 100+ countries, dedicated CSM’s, visa and PTO support, and more, Deel provides unmatched payroll expertise and service. Plus, with a single point of contact, we eliminate handovers, providing you with faster support and compliance, so your entire global team gets paid quickly and securely.

Best Credit Card Processing Companies In 2024

The platform focuses on keeping people paid with few bells and whistles. And unlike Wave Payroll, Square Payroll is tailored for businesses that employ both salaried employees and hourly workers who might earn tips. This niche appeal ensures that payroll computations are accurate and compliant in tip-heavy industries. Employees can easily pull detailed pay stubs and tax documentation.

Payroll software that pays off

Wave is a unique fit for microbusinesses and solopreneurs who pay a small team heavy in contractors and part-timers, and frequently invoice clients or customers for online payment. And, with the ability to pause the subscription, it is great for service companies such as landscapers who hire contractors often and endure off-seasons. It comes to the platform along with accounting, invoicing and payment processing for small businesses—replacing a laundry list of tools for many entrepreneurs. When you hire a new employee, its team of tax experts notifies the correct state entity as required by law.

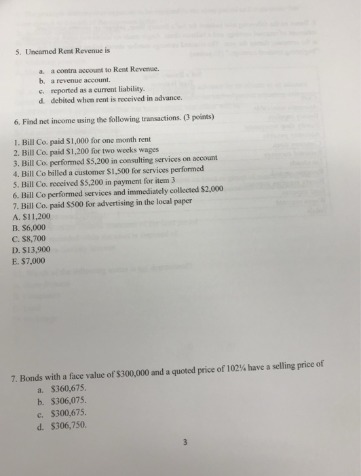

Employee-facing appeal

Wave payroll earned a low 2.9/5 star rating in the ease of use category, as the software can be tedious to set up, lacks many integrations, and doesn’t offer any white glove set up options. Businesses in states where tax services are available pay a base fee of $35 per month and an additional $6 per month for every employee or independent contractor. Wave’s pricing for its Payroll software is based on the services available in your state and how many employees you pay each month. When it comes to complying with local, state and federal payroll regulations, Wave Payroll lags behind.

- Through TriNet’s PEO, you can outsource all of your HR and payroll functions or you can choose which functions you want to outsource and which you’d like to keep in-house.

- We tried to ask a question through the chatbot feature and didn’t receive a helpful response.

- Plus, there are no advanced capabilities such as performance management.

When running payroll manually, Gusto takes you through three steps. The next step prompts you to enter any paid time off that employees took during the pay period. This is also where you can approve or deny https://www.accountingcoaching.online/investing-education-earnings-per-share/ pending time-off requests. From there, Gusto lets you preview the payroll run in the third step before submitting payroll. Upon submitting, Gusto confirms that you’ve successfully submitted payroll.

Lack of advanced HR features

In addition, it earns 4.6 stars from 718 user reviews on Capterra. Users say the service is easy to set up and use for both employers and employees and is easily scalable as a company grows. They do wish that Justworks offered more in the way of integrations with popular accounting and other software and some express the need for more customizable platform features. Since utilities expense was specifically created for startups and small businesses with limited to no payroll processing experience, the interface is easy to use. No matter how tech-savvy you are or aren’t, you’ll find the setup process simple as there are step-by-step instructions and a 24/7 chatbot to guide you. Wave Payroll is fairly basic with minimal features so you shouldn’t get overwhelmed as you might with more comprehensive payroll solutions.

Your employees can log into Wave securely to access their pay stubs and T4s, and manage their contact and banking information. The weather service is urging people to avoid the outdoors in the heat of the day. If that isn’t an option, look for shade and drink plenty of water. Temperatures inside closed-up cars can reach deadly heights in minutes, so children and pets absolutely cannot be left in them. Lilly Goodwin, a manager at Jimmie’s Ice Cream & Grill in Brewer, Maine, told USA TODAY the heat wave has fueled a surge in customers. The 22-year-old said the scorching weather “came out of nowhere” and led to long lines as sweaty patrons ordered and waited patiently for their strawberry, vanilla and chocolate cones.

By providing feedback on how we can improve, you can earn gift cards and get early access to new features. Wave has helped over 2 million North American small business owners take control of their finances. Wave has helped over 2 million small business owners in the US and Canada take control of their finances. Give your customers the option of paying with one click using a credit card, bank transfer, or Apple Pay. Automated, accurate payroll helps you stay compliant, save time, and be stress-free. AI-powered legal analytics, workflow tools and premium legal & business news.

Every time a payroll run is approved, the applicable bookkeeping information is logged in to Wave Accounting. The gross payroll amount is recorded in the expense category of your Account Mapping and included in the Profit and Loss report, as is the amount of taxes you owe as an employer. If your business is located in a state not covered by its tax services, Wave Payroll will calculate the applicable tax deductions from your employees’ pay. It will also generate Form W-2s that you can use to file year-end tax reports. Our guide to the best payroll services for small businesses contains our recommended pay processing solutions. Similar to its payroll processing features, Wave Payroll offers just enough employee management and PTO features to be functional.

More specifically, Wave Payments pricing starts at 2.9% + $0.60 per credit card transaction and 1% per transaction for AHC payments. If your business needs tax, bookkeeping, or accounting advisory services, Wave Advisor will provide them at a starting price of $149/month. Wave Payroll’s simple, low-cost features may be basic but they’re well-suited for small businesses needing an affordable all-in-one accounting and payroll solution.

And, in the long run, an online payroll software provider like Wave can save you a lot of money by reducing human error so you can avoid tax penalties (and who doesn’t love saving money?). Using research and writing skills from her academic background, Lauren prioritizes accuracy and delivering the best answer to the audience. She has over 13 years of writing and editing experience, including 2.5 years producing content about HR software and HR-related topics. Payroll refers to the total compensation a company pays employees for their work. Payroll also refers to the process of calculating employees’ net pay and initiating payment to them.

Yes, you can use https://www.adprun.net/ to pay independent contractors and regular employees alike. Regardless of the type of payee, the cost per person is an extra $6 per month on top of your monthly base fee. Essentially, running payroll yourself just means reviewing the numbers and pressing a button on the software to pay out your employees. But nothing can match the convenience of scheduling automatic payroll runs, so if you’re looking for more thorough automation, Paychex or ADP could be a better fit.

You may have better luck seeking support via the self-service Help Center. You might need to opt for paid add-ons to ensure you have all the “must have” features in your payroll service. If you can squeeze some “good to have” features as well, do so but don’t overextend yourself.