You may think that outsourcing is only a practice for large, well-established businesses that offshore basic operations. But in reality, many businesses across the country, big and small, are embracing outsourced accounting. Among all these day-to-day activities, it can be difficult to find time for your accounting, even though you know how important it is to your business. Maintaining accurate, timely financial information is vital in enabling you to make better decisions for your business.

Explore what you can do with QuickBooks

As a bookkeeper, you may also receive client payments and deposit them at your company’s financial institution. Position your firm as an industry leader by delivering the experience your clients deserve with enhanced response times. Outsmart your competitors by adding highly skilled accounting https://www.business-accounting.net/top-ten-internal-controls-to-prevent-and-detect/ professionals to your firm faster. A 360 solution to find, hire, onboard, pay, and retain top Latin American talent. Bookkeeping and accounting are both important aspects of a company’s finance management. At first glance, they can seem quite similar, but there are a few main differences.

The Ultimate Guide To Outsourced Bookkeeping 2023

If that description fits what you’re looking for, one of the nine best virtual bookkeeping providers can save you time, money, and stress. Bookkeeper.com’s cheapest virtual bookkeeping service starts with bookkeeping basics, like preparing key financial statements. From there, you can add comprehensive accounting, payroll, and tax services as needed. Bookkeeper.com manages your accounts using QuickBooks Online (or QuickBooks Desktop, if you prefer).

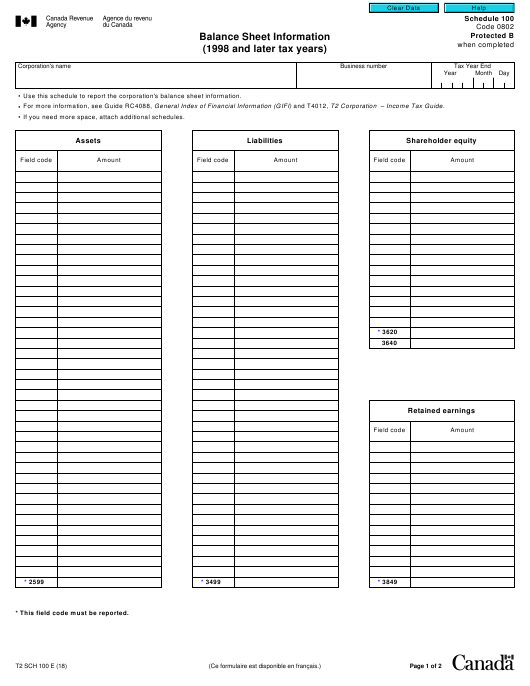

Ensuring Accuracy and Compliance in Tax Reporting

According to the US Bureau of Labor Statistics (BLS), most bookkeepers can learn the profession’s basics in about six months [3]. Once you become a qualified bookkeeper, you can work as a permanent employee or freelancer. You can learn bookkeeping for free and at a low cost through online courses. These courses focus on bookkeeping fundamentals to help improve bookkeeping knowledge and skills. For example, you might complete the Intuit Bookkeeping Professional Certificate or several other bookkeeping courses offered by universities and companies on Coursera. A bookkeeper checks for errors when creating reports and managing the general ledger.

Create financial reports.

Listen to your intuition and find an outsourced CFO you know you can trust. Picking the right fiscal year for your business can save you and your accountant a lot of time, money and stress. Your best bet is to find a local accountant who can take on the tasks you need, who will only charge you hourly for the work utilities expense you need. So you shouldn’t feel like you have to handle all the finances in your small business. Typically, there are a few signs that it’s time to leave the DIY behind and bring on a professional. Meet the team behind our successful journey to becoming the largest offshoring provider in the Philippines.

- As you grow, having a professional, outsourced accountant on your side gives you the advantage of proactivity rather than reactivity.

- In researching bookkeeping or bookkeeping accounting, you may come across information on accounting or find that bookkeeping and accounting are used interchangeably.

- It discusses the benefits, risks, and strategies for successful outsourcing, focusing on optimizing operations, improving customer service, and ensuring effective partnerships.

- Freelance bookkeepers may be able to work online, in-person at your business, or both.

Compliance and Security in Bookkeeping Outsourcing

Some bookkeeping services can provide a full suite of bookkeeping, accounting and tax services. Examples include bookkeeping journal entries, bookkeeping ledger, bookkeeping reconciliation and bookkeeping trial balance. Each plan comes with a finance expert, automated transaction imports, P&L, balance sheet and cash flow statements. https://www.kelleysbookkeeping.com/ You’ll also get burn rate calculations, which is helpful for startups that need to closely track their spending. It’s also ideal for brand-new businesses because FinancePal can help with entity formation. Start by conducting thorough online research and seeking recommendations from colleagues, peers, or industry associations.

Financial institutions, investors, and the government need accurate bookkeeping accounting to make better lending and investing decisions. Bookkeeping accuracy and reliability are essential for businesses to succeed for staff, executives, customers, and partners. Despite the benefits, hybrid models require effective management of communication and cultural alignment between in-house and outsourced teams. Companies must ensure data security, maintain quality standards, and align all members with the company’s objectives and ethics. Prioritize critical tasks essential to your firm’s long-term success while your outsourced accounting team manages routine tasks.

Communication is done either online or via telephone, and you have the option to pay as you go. One important similarity is that, like with bookkeeping, outsourcing accounting can be a highly efficient approach if you collaborate with the right provider. Its software is compatible with a wide range of bookkeeping programs and provides a great way for you to leave the tedious work in the hands of skilled professionals. Once you have narrowed down your requirements from a bookkeeping provider, it’s time to research and select the partner that fits the bill. Bookkeeping is essential for many business functions, from analyzing your company’s performance to budgeting to meeting tax compliance standards and government regulations.

But the fact that public companies are embracing outsourcing shouldn’t dissuade you from exploring outsourcing elements of your own business. Pilot is a provider of back-office services, including bookkeeping, controller services, and CFO services. Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy. There are online/remote accounting firms, but based on their low reviews, we can’t recommend any of them in good conscience.

One downside, however, can be the possible incompatibility between its accounting software and yours. Elevate your hiring process with Job Description Generator – a tool to create customized, compelling job descriptions, attracting the right candidates effortlessly. Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development.

Outsourcing bookkeeping tasks has emerged as a valuable solution for businesses looking to optimize their financial operations. By leveraging the expertise and resources of external bookkeeping service providers, companies can achieve greater accuracy, timeliness, and efficiency in their financial management practices. Bookkeeping outsourcing is a strategic move that allows organizations to streamline their financial management procedures, save expenses, and increase accuracy. You can confidently pick the ideal outsourced bookkeeping service and develop a productive partnership that promotes your business’s success by following the principles mentioned in this detailed guide. Embracing the power of outsourcing helps you to focus on core operations, harness financial professionals’ skills, and earn crucial time to make educated business decisions.