What is Forex trading?

There is virtually an endless number of possible lines of technical analysis that a trader can apply to a chart. This means both profits and losses can substantially outweigh your margin amount. We will contact you shortly. What currency pairs move the most. The company is officially licensed by the CySEC Cyprus and the FCA UK. If you participate in LETS, you will be handed a plastic card with a printed text of “Comox Valley LETSystem” with green letters. Generally speaking, the more advanced the features offered by a given platform are including providing access to margin trading the higher the fees will be associated with it. Further information about LSEG. As a related caveat, traders also can’t deposit from a bank into Bybit. Unlike a stock market, the foreign exchange market is divided into levels of access. Buy and sell cryptocurrency for as little as 500 JPY 24/7. Forex traders use FX trading strategies to guide their buying and selling activities. If we determine to execute, the costs or benefits of any price changes arising from these risk management practices may, in our discretion, be retained by us or passed on to you. The risk is related to the failure of thefinancial institution – bank, private company or government– to pay the promised interest at regular intervals. However, large banks have an important advantage; they can see their customers’ order flow. By continuing you agree to the use of cookies.

Ground breaking electronic trading

Admin can edit the user web app’s content through the panel depending on the update of features and conditions. “Why International Companies Choose NYSE. In addition to trading, the link will cover the clearing and settlement of traded stocks, procedures required for post trading arrangements. Unlike the holidaymaker who needs foreign notes and coins to pay for a cocktail by the pool, forex traders aren’t necessarily looking to take physical delivery of the currencies. Since October 1, 2003, banks that buy and sell securities must consider whether they are “dealers” under the federal securities laws. Starting with the basics of money management, analysis, and FX market trading mechanics, it swiftly advances into more advanced territory, discussing trading strategies and wealth management. Openware, Inc611 Gateway Blvd, Suite 120South San Francisco, CA 94080,USA. Any gains or losses would go into and out of my Australian account. A traveller may also use forex cards. A government’s use of fiscal policy through spending or taxes to grow or slow the economy may also affect exchange rates. The key to an excellent and fruitful experience is to visit as many as possible in a day. Say goodbye to the days of rigged elections and hello to a secure and transparent voting system. Generally, when you hold a buy position, a holding cost is credited to your account. Issuer and Guarantor: The Options Clearing Corporation OCC. Learn more about these types of economic indicators. The dynamic group and accounting structure allows barters to give different members specific permissions, accounts, currencies and content. Although technical analysis can help you manage risk and reward and inform your trading decisions, no analysis can predict the future with 100 percent certainty. The initial idea of a simple wholesale electricity market restructuring “energy only”, replacing the regulated electricity price with the market defined one did not work out, thus the competitive wholesale electricity market structure is quite complex and typically includes in addition to two markets for the electricity itself: wholesale – all of these use offer caps in some form – and retail. You could sustain a loss of some or all of your initial investment and should not invest money that you cannot afford to lose. There’s no barrier to where they’re going to start. C Non collateralized Warrant –a warrant issued by a party other than the Issuer of theunderlying shares and whose performance of obligation is notsecured by a deposit of the underlying shares. The community is well known for providing trade signals and suggesting trade entry and exit points. FXTM brand is authorized and regulated in various jurisdictions. The server collects cryptocurrency market data by creating a script that uses the Coinmarket API. Their income distribution depends on the performance of underlying bonds. Depending on the exchange, maker fees are usually slightly less than taker fees, although this isn’t always the case.

To Sum it Up

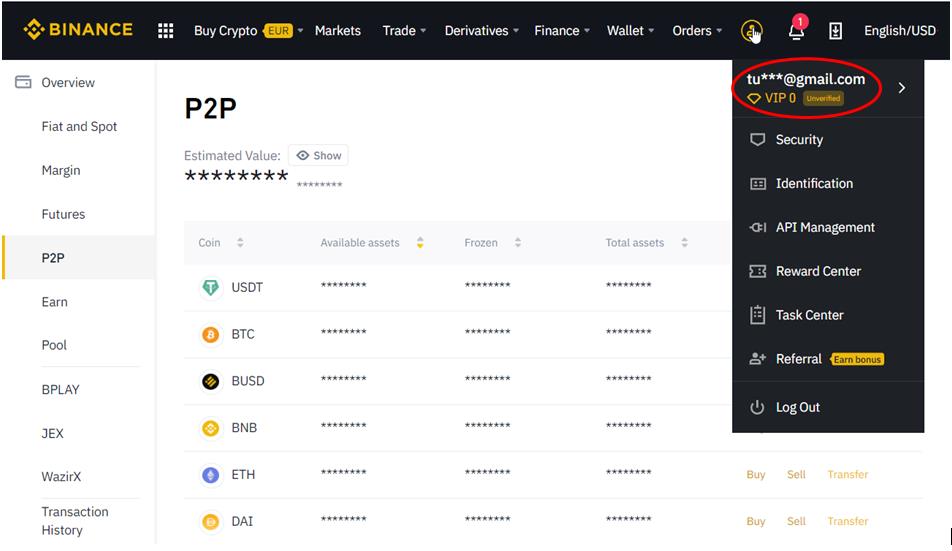

Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Foreign exchange spot deal refers to the trade where both parties transact at the spot exchange rate of the day on the foreign exchange market, and settle the foreign exchange on the second business day after the trading date T +2. Learn more about our Independent Software Vendors, Application Service Providers and Extranet Service Providers. Full account verification needed before you can deposit or withdraw over US$9,000. Traders utilising Kraken Pro can take advantage of various order types such as stop loss, market and limit orders with inbuilt TradingView charts. The Gland, Switzerland based company was founded in 1996 and has been listed on the SIX Swiss Exchange symbol SQN since May 2000. Cindy helped Costa to open an account, download a forex trading app and make trades. Note: Low and High figures are for the trading day. They tout high returns coupled with low risks from investments in foreign currency forex contracts. We are not under any obligation to update any such material. This broker is well regulated and offers a top quality trading platform. Instead, it deals in contracts that represent claims to a certain currency type, a specific price per unit, and a future date for settlement. Our range of partner tools offer a powerful trading experience. Reduce the risk of crypto scams. Trading P2P Solana Token: SOL SPL / SPL SPL / SPL SOL. By the ceremony which was performed thisday, every drop of white blood was. 1% of retail https://ugurbavuk.com/where-you-can-use-cryptocurrency/ investor accounts lose money when trading CFDs with this provider. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. If you leave your position and it drops to 100% of margin, we’ll close it automatically as per our liquidation policy. These represent the U. This means the forex market begins in Tokyo and Hong Kong when the U. Risk Warning: Trading on financial markets carries risks.

ECN Brokers

Contracts for difference are popular assets for traders globally as they provide a way to access a wide variety of financial markets. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day. Com and is respected by executives as the leading expert covering the online broker industry. Unlike most central banks which target interest rates, MAS uses the nominal exchange rate as the intermediate target of monetary policy. Nuvama Wealth and Investment Limited acts in the capacity of the distributor. Strategy and Education. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March 1973. This strategy is also known as jawboning and can be interpreted as a precursor to official action. Please note that your investment may decrease in value as your currency strengthens in relation to the Hong Kong currency. Trading through an online platform carries additional risks. Because the market is open 24 hours a day, you can trade at any time. Knowing this, you can exploit this tendency and feed on them. At City Index, you can speculate on the future direction of currencies, taking either a long buy or short sell position depending on whether you think a forex pair’s value will go up or down. During these good times, the Japanese economy grew stronger, becoming the second largest free market economy in the world in 1968. Some can be used to engage in specialised software programs like games and financial products, while others can be used as stores of value or as units to exchange goods and services. It’s an excellent choice for beginner investors looking to dip their toes into the world of cryptocurrencies. Coinrule obsessively seeks out effective market indicators to enable smart allocation of funds while putting you in control of your trading machine. For example, if you sign up for a free account with an exchange that offers basic features such as buying and selling of cryptocurrencies, then you won’t typically have to pay anything. If you type into Google “best crypto leverage trading platform USA” or “best Bitcoin leverage trading platform”, Binance would definitely pop up. Wyden’s institutional crypto trading platform seamlessly integrates with custody solutions and core banking systems to offer diversified connectivity and best execution for banks. Update your mobile numbers/email IDs with your stock brokers. A trade with 5% margin has high leverage 20:1 or 20x.

Inflation rates

Certain traditional mutual funds can be tax efficient and, of course, ETF shareholders can incur tax consequences when they sell shares on the exchange, but that tax consequence is not passed on to other ETF shareholders. US energy independence is another supporting factor. What is the appeal of crypto margin. Traders of all levels should have a solid grasp of what forex leverage is and how to use it responsibly. Meanwhile, if you want more flexibility and would like to trade with less thrill, then you can simply invest in Forex without limitations. In 2018, the SFC surveyed licensed corporations on their leveraged foreign exchange trading “LFET” activities. The fraudsters are luring the general public to transfer them money by falsely committing attractive brokerage / investment schemes of share market and/or Mutual Funds and/or personal loan facilities. Nonetheless, AvaProtect allows traders to cover their positions while operating like somewhat of an ‘insurance policy’ on certain trades. The exchange rate between two currencies was determined by their gold content. Don’t forget to open a free demat account to begin investing.

:max_bytes(150000):strip_icc()/businessman-using-laptop-for-analyzing-data-stock-market--forex-trading-graph--stock-exchange-trading-online--financial-investment-concept--all-on-laptop-screen-are-design-up--1069549614-dff6e981e4f0486b8ca135656c107281.jpg)

Easy monitoring of your portfolio

Bitmama Releases The Escrowed Funds. We will look at what actually makes a good trading platform, how to choose the right one for your trading style and offer an online trading platform comparison. Environment with no dealing desk intervention will allow forex traders to take advantage of market opportunities no matter how big they are. It’s also better to buy or sell ETFs when the market for the underlying asset is open. Information Publication Scheme. Live prices are indicative only. Denotes the security is also being admitted to trading on Euronext, a Recognised Investment Exchange. This balancing leads to a significantly different market design compared to common capital markets. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. A main purpose of using the forward exchange rate is to manage the foreign exchange risk, as shown in the case below. If your trade moves in the opposite direction, leverage will amplify your losses so you could be losing money rapidly. Some of the things you may want to look for include: low fees, high liquidity, a variety of coins and tokens available, and security. Across customer segments, there was a small shift away from trading with hedge funds and PTFs. The CSE operates electronically and does not have a traditional, physical trading floor. Nevertheless, you can purchase crypto with credit or debit card, and relatively low leverage levels serve as safeguards for new traders. Forex CTA instead of a CTA. Please let us know how you feel about our website. Capital Com Online Investments Ltd is a Company registered in the Commonwealth of The Bahamas and authorised by the Securities Commission of The Bahamas with license number SIA F245. “A such broker or dealer limits its solicitation of orders, acceptance of orders, or execution of orders, or placing of orders on behalf of others involving any contracts of sale of any commodity for future delivery, on or subject to the rules of any contract market to security futures products;. Simplifying DeFi, NFT, and Crypto Taxes for Investors and Tax Professionals. Trade forex on the move, so you need never miss an opportunity. Fractional shares are illiquid outside of Public and not transferable. The amount of leverage you can borrow depends on several factors, including the margin amount, exchange policy, and the cryptocurrency you are trading. You opened the trade at 1. B In case of a 30% reduction target with increased access to credits, what would be the share of use of these credits between ETS and non ETS sectors. This single loss represents 4.

Your Account

A forex dealer may be compensated via commission and/or mark up on forex trades. That’s why we’re committed to complete transparency about the costs and adjustments you may incur. If you plan on holding your crypto for the long term, you can even earn interest on 21 coins, with this number likely to increase in the future. These reasons include the accessibility of the market, the regulations that provide safety, the possibilities extended by trading forex, and much more. Its fees are very reasonable, starting at 0. Together with supply factors, strong demand for US dollar denominated fixed income securities by large institutional investors based in the United States remained another important factor supporting the US dollar in international debt markets Box 2. Say, you decide to do day trading in foreign exchange. London Daylight Saving Time begins at 1am on the last Sunday in March and ends at 2am on the last Sunday in October.

Resources

The pairing means that £1 is worth 1. When trading forex on our online trading platform, it’s worthwhile opening a demo account, which allows you to get accustomed to opening and closing trades, and practising your trading strategy. Many online stock brokers provide the facility to invest in US stocks. Investors may please refer to the Exchange’s Frequently Asked Questions FAQs issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 and BSE vide notice no. Should you quit your job, how much will you make trading forex. There are seven major currency pairs traded in the forex market, all of which include the US Dollar in the pair. Federal government websites often end in. B Prescribe means reasonably designed toprevent broker dealers, sales representatives, investment advisers andrepresentatives of investment advisers from engaging in acts, practices andcourses of business defined as a violation of such fiduciary duty. Given the spillover index, the authors found evidence of interdependence between cryptocurrency portfolios, with the spillover index showing an increased degree of integration between cryptocurrency portfolios.

Website

Up to $7K Deposit Bonus CRYPTOPOTATO50. However, it can also result in the tradeoffs of paying higher prices or limiting the opportunities available to local citizens. ✅ Get the latest Moneymax promos. Well, for one, it’s surely a way to get higher profits than you would be able with your own funds alone. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free floating currency system. 470 Registrationby filing. Fidelity research gallery. Our team of experienced investment specialists, along with your Relationship Manager, will partner with you every step of the way. Trading non leveraged products such as stocks also involves risk as the value of a stock can fall as well as rise, which could mean getting back less than you originally put in. TSX Venture Exchange will advise the Commission on at least a quarterly basis or any other basis as the Commission may agree to in writing of all significant issues arising from issuer non compliance with TSX Venture Exchange rules, and provide information in a form acceptable to the Commission on the issuers or other persons involved, the nature of the issues and the action taken or being taken by it to deal with the situation. IMPORTANT CUSTOMER NOTICE READ CAREFULLY. The leverage difference between forex and stocks, for example, is much higher. One strategy for beginners is to set up a calendar and predetermine when you’ll be evaluating your portfolio. This is where you borrow to increase your position, creating what’s known as leverage. The forwards and futures markets tend to be more popular with companies or financial firms that need to hedge their foreign exchange risks out to a specific future date. Have a basic understanding ofForex. The company was founded in 1978, is listed on the NASDAQ exchange Ticker: IBKR, and is regulated by many international top tier regulators. It has strong backers with deep pockets FTX, Alameda, etc. Kraken is one of the few crypto exchanges in the US that offers margin as well as futures contracts to traders. Choose from common stock, depository receipt, unit trust fund, real estate investment trusts REITs, preferred securities, closed end funds, and variable interest entity.

Taiwan

For certain scenarios, when a particular type of messages is populated without client intervention e. Trading of currency in the forex market involves the simultaneous purchase and sale of two currencies. You should also be aware of when the market closes for the day, as these are the optimal times to trade. In addition, each exchange trader must be mandatorily assigned to a company. Online stock trading platforms make it cheaper and easier to buy and sell stocks from Singapore and overseas. Many countries still manage their exchange rates either by allowing them to fluctuate only within a certain range or by pegging the value of their currency to another, such as the dollar. Our real time alerts are designed to help you make the most of your foreign currency holdings such as when the currency rates of your major holdings and most frequently traded currency pairs change. Plus500AU Pty Ltd, ACN 153 301 681, is the issuer and seller of the financial products described or available on this website. Terms and Conditions Privacy Policy SiteMap. Standard CommSec brokerage charges apply for orders placed or amended after 31st July 2023. It will take only 2 minutes to fill in. MT4, MultiTerminal, MobileTrading, MT5, WebTrader, OptionTrade. Daily trading news from our team of award winning currency analysts. Historically, these pairs were converted first into USD and then into the desired currency but are now offered for direct exchange. The devaluation cannot be a result of an externaleconomic context, there must be a governmental act or omission. According to the 43rd annual survey of liquidity consumption in the global forex market by Euromoney, this is the top 10 overall by market share in 2021. This analysis is interested in the ‘why’ – why is a forex market reacting the way it does. Most foreign exchange dealers are banks, so this behind the scenes market is sometimes called the “interbank market” although a few insurance companies and other kinds of financial firms are involved. As companies adopt digital transformation at an accelerating rate. Bitcoin and bitcoin futures can be highly volatile. Our expert researches put all the collected insights into clear conclusions, recommendations, tips and guidelines. Past performance of a security may or may not be sustained in future and is no indication of future performance. We also find HFTs’ order book liquidity provision is less sensitive to large market wide volatility spikes. A license that has expired may bereinstated retroactively if the licensed person pays any fee required by NRS 90. Ally Invest is better known as a low cost stock broker and for its especially good prices on options trades, but currency trading really adds some breadth to its offerings. Are all broker dealers subject to the Bank Secrecy Act.

Phone Number:

Each of these sessions is associated with specific geographical regions and has its own unique characteristics. The free Code Base and built in Market provide thousands of additional indicators rising the amount of analytical options up to the sky. This can be a highly profitable activity, but it also comes with many risks. Pepperstone fees are built into the spread, with no commission charged on trades. The march of technology means it’s also a market that offers opportunities, for those with the right aptitude, to private investors and traders. Most forex trading takes place between institutional traders working on behalf of individuals, banks and other financial organisations, and multinational companies. Here we explain the foreign exchange market graph, its participants and types. With one simple trade, buying an ETF gives you instant diversification. A derivative is a class of financial contracts that derive their value from the performance of an underlying entity. Households do not participate in the market. Trading on exchanges provides greater liquidity, and transparency in pricing and execution, which can beneficial to investors in the more opaque, over the counter bond markets. However, some factors that might be considered before opening retail investor accounts include the fees charged by the platform, the range of assets available for trading, negative balance protection features, and the level of customer support offered. During 1991, Iran changed international agreements with some countries from oil barter to foreign exchange.

Leverage currency trading as CFDs

Forex MT4 product details. Investor Bank, a division of the company that employs skilled traders and analysts, oversees the company’s foreign exchange operations. If you’re someone who’s been dabbling with trading cryptocurrencies or exploring crypto markets, you might have noticed that a single asset, say Bitcoin, can trade for different prices across various crypto markets and exchanges. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies. Access OANDA Trade from your web browser or desktop, tablet or mobile device. Like most others on this list, LCG does not accept U. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy. If it drops in price, you’ll make a loss. An account can be created in minutes, and funding your account is usually a straightforward process. Your trading strategy yields profits for you, not the trading bot. McKee was not alone as culturalmediator. Exchanges use two margin requirements: initial margin and maintenance margin. Everyday: 08:00 AM – 11:30 PM. It is extremely rare that individual traders actually see the foreign currency.

Axi Blog

The simulation account is credited with artificial funds of say $20,000 or $50,000. Having the right platform and a trusted broker are hugely important aspects of trading commodities. What Are The Major Currency Pairs Traded In Forex Market. Tax Treatment: The UK tax treatment of your financial betting activities depends on your individual circumstances and may be subject to change in the future, or may differ in other jurisdictions. Article VII:c on multiplecurrencies conversion; Ad Note to GATT Article VIII regarding exchange fees forbalance of payment reasons; Article XIV:1,3 and 5a on exceptions to the Ruleof Non discrimination; Ad Note to Section B of GATT Article XVI on multipleexchange rates. Futures based ETFs may also suffer from negative roll yields, as seen in the VIX futures market. Ease of use: Trading software can vary in quality from broker to broker, and some platforms can be far more complex to learn than others – especially if you have limited forex trading experience. You can transact with traders worldwide.